The term “What is a Trust Fund” often conjures images of wealthy families passing down fortunes—but in reality, trust funds are versatile financial tools accessible to anyone looking to secure their legacy. Far more than just a vehicle for the ultra-rich, trusts offer structured, tax-efficient, and flexible ways to manage assets for future generations.

What Exactly Is a Trust Fund?

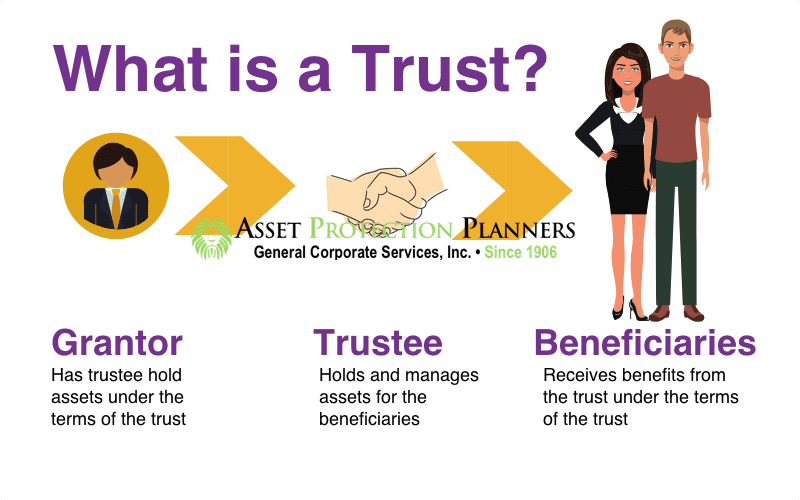

A trust fund is a legal arrangement where a grantor (the person creating the trust) transfers assets to a trustee (a person or institution managing the trust) for the benefit of designated beneficiaries. Unlike a simple will, a trust allows for precise control over how and when assets are distributed, often bypassing probate court delays and maintaining privacy.

Main Components of a Trust Fund

- Grantor (Settlor): The individual who creates and funds the trust.

- Trustee: The manager responsible for administering the trust per the grantor’s instructions.

- Beneficiaries: Those who receive the trust’s assets, whether immediately or over time.

Why Use a Trust Fund? Key Benefits for Your Loved Ones

Trust funds aren’t just for multimillionaires—they serve practical purposes for families at various wealth levels:

- Avoiding Probate Delays and Costs

Wills have to go through probate, which is a public court process that can take a long time. Trusts, however, transfer assets directly to beneficiaries, saving time (sometimes years) and legal fees.

- Protecting Assets from Creditors and Poor Financial Decisions

If a beneficiary is financially irresponsible, a spendthrift trust can restrict access to funds, releasing money only under specific conditions (e.g., reaching a certain age or achieving milestones like college graduation).

- Helping in reducing Estate Taxes

High-net-worth individuals use irrevocable trusts to shield assets from estate taxes, ensuring more wealth passes to heirs rather than the IRS.

- Providing for Special Needs Dependents

A special needs trust ensures disabled beneficiaries receive financial support without disqualifying them from government assistance programs like Medicaid.

Types of Trust Funds: Which One Fits Your Needs?

Not all trusts act the same way. The right choice depends on your goals—whether it’s flexibility, tax savings, or asset protection.

Revocable Living Trusts (Flexibility During Your Lifetime)

- Control: The grantor can modify or dissolve the trust anytime.

- Avoids Probate: Assets transfer smoothly to beneficiaries after death.

- No Tax Benefits: Assets remain part of the grantor’s taxable estate.

Best for: Individuals who want control over their assets while alive but a seamless transition afterward.

Irrevocable Trusts (Strong Asset Protection & Tax Advantages)

- Permanent: Once established, terms generally cannot be changed.

- Estate Tax Shield: Removes assets from the taxable estate.

- Creditor Protection: Safeguards assets from lawsuits or debt claims.

Best for: Those with significant assets seeking tax efficiency and legal protection.

Testamentary Trusts (Created Through a Will)

- Activates After Death: Funded through the probate process.

- Customizable Distribution Rules: E.g., funds released when a child turns 25.

Best for: Parents who want to leave assets to minors under controlled conditions.

Charitable Trusts (Philanthropy with Financial Perks)

- Donor-Advised Funds: Allow charitable donations while offering tax deductions.

- Income Stream Options: Some trusts provide the grantor or beneficiaries with periodic payouts.

Best for: Individuals passionate about philanthropy while retaining financial benefits.

How Does a Trust Fund Work in Practice?

Step 1: Establishing the Trust

The grantor creates a trust agreement, stating:

- Who the beneficiaries are

- How and when distributions occur

- Who serves as trustee (and successor trustees)

Step 2: Funding the Trust

A trust only controls assets transferred into it. Common funded assets include:

- Real estate

- Bank accounts

- Investments (stocks, bonds)

- Life insurance policies

Step 3: Trustee Management

The trustee administers the trust per the grantor’s instructions, which may include:

- Investing assets wisely

- Distributing income to beneficiaries

- Filing tax returns for the trust

Step 4: Beneficiary Distributions

Depending on the trust’s terms, beneficiaries may receive:

- Lump-sum payments (e.g., at age 30)

- Regular income (e.g., monthly stipends)

- Conditional distributions (e.g., funds for education only)

Frequently Held Myths Regarding Trust Funds

Myth 1: “Only the Wealthy Need Trusts”

Even modest estates benefit from avoiding probate and ensuring structured inheritance.

Myth 2: “Trusts Are Too Complicated to Set Up”

Modern online estate planning tools simplify the process, making trusts accessible without exorbitant legal fees.

Myth 3: “A Will Is Enough”

Wills don’t avoid probate, lack privacy, and offer no asset protection—key advantages trusts provide.

Who Should Consider a Trust Fund?

Trusts aren’t one-size-fits-all, but they’re worth exploring if you:

- Own property (especially in multiple states)

- Have minor children or dependents with special needs

- Want to minimize estate taxes

- Desire privacy in asset distribution

Final Thoughts: Is a Trust Fund Right for You?

Understanding What is a Trust Fund is the first step in leveraging its power for your family’s future. Whether you seek to avoid probate, protect assets, or provide structured support for loved ones, trusts offer a strategic way to ensure your legacy is managed exactly as you intend.

In addition to the core benefits outlined above, trust funds can also play a crucial role in blended families or complex family situations, where you may want to ensure specific assets go to certain heirs or provide ongoing support to a spouse while preserving the principal for children from a prior marriage. Trusts can help prevent family disputes by clearly outlining the grantor’s wishes and reducing ambiguity in asset distribution. Furthermore, trusts can be structured to support philanthropic goals, such as establishing scholarships or funding charitable organizations, leaving a meaningful legacy beyond immediate family. As life circumstances and laws change, regularly reviewing and updating your trust ensures it continues to reflect your intentions and provides optimal protection for your beneficiaries.

“A well-structured trust is more than a financial tool—it’s a lasting expression of care for those you leave behind.”

By evaluating your needs and consulting an estate planning professional, you can create a trust that aligns with your goals, providing security and clarity for generations to come.